A credit score is like your key to approval and access. Without a good credit score, you miss out on some of the necessities and luxuries in life, like purchasing a car or a home. It can take several years to build your score, without which your credit history is practically non-existential.

What is a Credit Score?

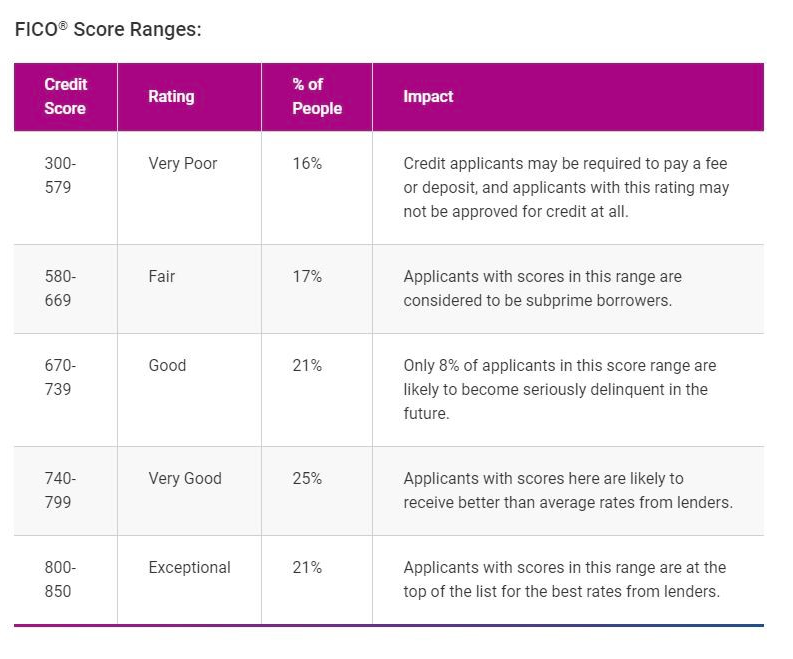

A credit score is an analysis of your creditworthiness. The research is a compilation of a person’s credit history and files. The number that represents your score is usually anywhere between 300 and 850. The higher the score, the better. Your credit score helps lenders determine whether you can repay any type of debt. It could be a car you’re trying to purchase, applying for a loan, or even something as simple as a phone plan.

Maintaining a good credit score is crucial if you plan on making large purchases or applying for a loan. However, credit checks can damage your score.

The most common need for a high credit score is to obtain a loan. A microloan is usually the best option to borrow fash cash because of its flexibility and easy payback options. What some may wonder is if a microloan can hurt their credit score.

To answer this question, let’s explore this more.

What is a Microloan?

Microloans are small loans lent to businesses or individuals to aid their financial needs. These loans can go from a few hundred dollars to thousands. There are many reasons why people will want to choose a microloan over a traditional one.

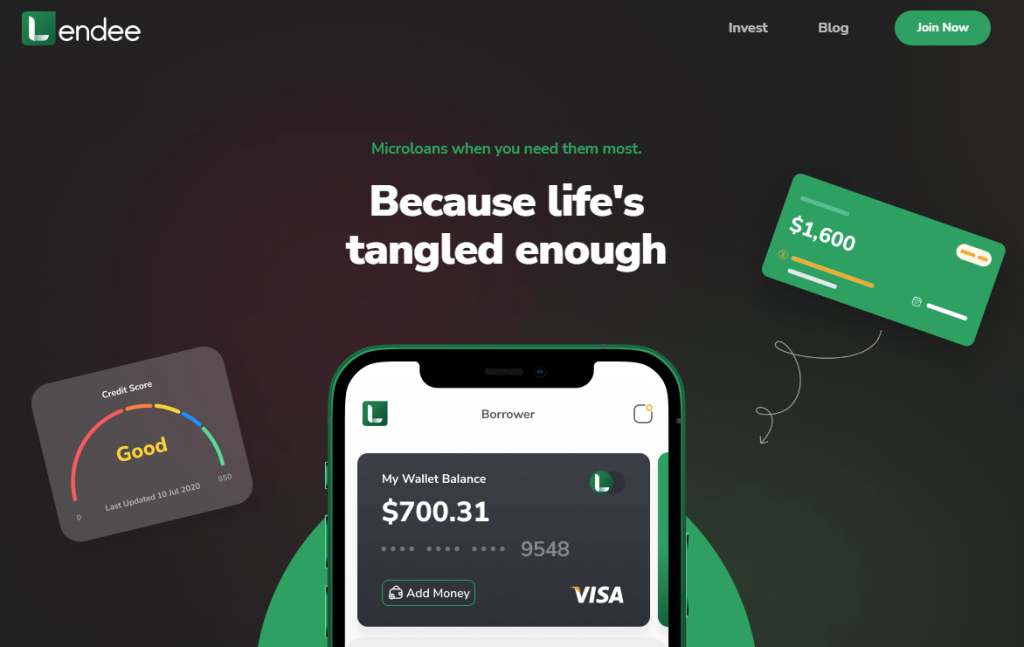

Microloans are easier to get, mainly when you use a money-borrowing app like Lendee. Most microlending platforms require less documentation, and the application process isn’t as lengthy. The wait time is short compared to a personal or business loan. These factors are beneficial, especially if you need fast money. There may be an emergency or a pending need for a small amount of money that a microloan can help recover.

You cannot apply for a microloan to manage personal expenses. You also can’t use it to pay off business debts. Depending on the lender, you can use your microloan towards purchasing office supplies, paying employees, buying inventory, furniture/fixtures, or machinery. A personal loan would be more suitable if you need funds for individual needs.

In addition to being easy to apply for, microloans can also help improve your credit score.

How Microloans Impact Credit Score

When applying for a microloan, lenders will consider your personal credit history.

A microloan can be good or bad for your credit. Certain aspects are inevitable, but the rest depends on your steps after obtaining the loan. For example, defaulting on a loan can negatively impact your credit.

Defaulting – When you no longer make your payments towards your loan.

By doing this, your personal and business credit will take a hit because, as a borrower, you promise to repay your debt within time.

The application process for a microloan will require a hard inquiry.

Hard Inquiry/pull or Hard Credit Check – When a lender or company requests to view your credit report, that request is recorded on your credit history. It can negatively impact your score, especially if you have too many inquiries on your account.

To avoid a hard credit pull, you can prequalify for a loan. But it depends on the lender and if they offer that option. Your current credit status will also play a role in this. Instead of applying, you need to answer a few questions about yourself, your employment status/history, income, and expenses. If this resonates with your lender, they will create an offer without having to do a hard credit check.

A prequalified loan is perfect if you want to explore other options. It allows you to compare with other lenders and choose which loan suits your needs best according to its terms/conditions.

Although avoiding a hard pull is every borrower’s dream, it is most likely inevitable. Even after answering the given questions and having the lender prequalify you, they require a hard check to approve the borrower.

The benefit is that by getting prequalified, you are aware of your odds when applying. The chances of rejection are low. Therefore, the application is ultimately worth it.

There are a few other ways a microloan can impact your credit score:

Potential high-interest rates/fees – Some microlenders offer loans at a high-interest rate. You could potentially avoid this if you have a high credit score, but depending on your credit, you may face a higher interest rate.

You must be able to afford a high-interest rate if you accept the loan. Else, it’ll take longer to pay off and can lower your credit score. If you can manage well, a high-interest rate won’t impact your ability to repay the loan. Instead, it can have a positive impact on your score.

Increased debt – Any form of loan or borrowing is potential debt. You increase your chances of falling into debt each time you accept a loan or borrow from a lender/company.

Obtaining a loan is not always a negative route, especially if you can pay it back. You must consider everything before applying and accepting one.

Can a Microloan Have a Positive Impact?

The answer is yes.

Manage Expenses – A microloan is worth it if your business can flourish or if it can help take care of your immediate financial needs. You don’t want to put off your crucial necessities due to the lack of funds. It’ll slow down your growth or become an obstacle in managing critical situations.

Payment History – Your payment history helps showcase your ability to repay a loan. By making payments on time and in full, you build a positive payment history which is excellent for your credit score. Future lenders will see this and will be more likely to approve your application.

Your payment history makes up about 35% of your FICO score. FICO stands for Fair Isaac Corporation and is the number that represents your creditworthiness. Taking the proper steps by making payments on time and repaying your loan faster will help you build your credit score.

Things to Consider When Applying for a Microloan

Your Reason – You should consider the following:

- Do I need it?

- Will it help solve my situation?

- Does it prevent further loss or damages?

Your Credit Score/History – Do you have a good credit score? If you apply for a loan, will you take a hit on your score for nothing, or is it worth it? If you know you’ve got good credit history, that’s great. But if you’re taking a chance knowing you have a bad credit score, you’re asking for trouble.

Your Debt-to-Income-Ratio – Your debt-to-income ratio measures your monthly debt compared to your monthly income. If your debt is higher than your income, you should reconsider applying for a loan. Chances are you’ll face rejection, or repayment will be difficult.

Explore The Right Options

Each microlender varies in fees, interest rates, and terms/conditions. It’s essential to explore all your options before choosing to apply for a loan.

You can make most applications online and find all their information on the website. A money-borrowing app such as Lendee provides borrowers with all the information they need before taking the plunge.

This microlending platform gives you many options before choosing a lender and simplifies the process. Getting fast money is one of the benefits of borrowing with Lendee. The approval rate is high as Lendee has a pool of lenders who will be willing to help.

Lendee is an ideal microlending platform to borrow a microloan at a competitive rate and improve your credit score. After all, small loans are easier to pay off.